Empowering You To Better Understand Your Finances

As financial advisors with more than 35 years of combined experience, we offer expert tips on financial planning. Our insights arm you with actionable advice to improve your financial life.

Blog

- All

- Budgeting & Money

- Financial Planning

- Retirement

- Credit

- Cash Flow

- Equity Compensation

- Restricted Stock Units (RSU's)

- Stock Options

- Estate Planning

- Fiduciary

- Insurance

- Investing

- Taxes

- Saving

- Benefits

- Goals

- Kids

- Real Estate

- Education

- Uncategorized

- Resources

- Behavioral Finance

- Digital Assets

- Business Owners

- Kiplinger Articles

- Fees

- Economy

- Cyber Security

Why Your Social Security Statement Is Important (and How to Review It)

Reviewing your Social Security statement and estimated benefits online is fast and easy, plus it can help you with retirement planning and knowing whether the SSA has accurate information on file. Read More

Managing Your Credit Score: Myths Debunked & Strategies

In this video, Paul Sydlansky, CFP®, tackles the myths surrounding credit scores and offers actionable tips for effective credit management. Read More

5 Helpful Finance Books for Your Next Weekend Read

Looking to level up your financial knowledge this weekend? Check out our top book picks that cover everything from the basics to building wealth. Read More

Making Sense of Your Cash Flow

Discover how breaking down your expenses into simple categories can transform your approach to budgeting. Read More

5 Things You Probably Don’t Know (Yet) About 529 Plans

If you’re a parent, you’ve probably heard about 529 plans, and if not, now’s the time to get informed. A solid 529 plan can help you save for your child’s education and get on the path toward professional and financial success. Read More

3 Big Questions Mid-Career Professionals Should Ask Now

As you navigate your 40s and 50s, strategic financial planning becomes crucial. Discover three big questions you should ask yourself to be sure you’re still on the right path for retirement and financial independence. Read More

Aligning Your Investments & Your Goals

Paul Sydlansky, CFP®, guides you through aligning your investments with personal goals. Learn what kinds of accounts you should use for different goals, like emergency funds, your children's futures, retirement, and more. Read More

How to Choose the Right Financial Advisor for You

Choosing the right financial advisor is critical for navigating complex financial decisions and getting guidance to help meet your goals. In this video, Paul Sydlansky, CFP®, shares the questions you should ask when trying to find a financial professional that’s a ... Read More

What If You Got Sick or Injured? 3 Reasons Why You May Need Disability Insurance

If you were sick and injured, and unable to work normally, how would you cover your existing income? This is where disability insurance can help. Read More

Open Enrollment is Coming: Are You Adequately Covered?

It’s October, which means annual open enrollment opens soon for many people, so now is the perfect time to start re-evaluating your benefit needs. Outside of qualifying events like having a child or switching employers, it’s almost impossible to make a change in your coverage outside of the open enrollment period so it’s critical that you take the time to make the right selections. To help you prepare for this year’s open enrollment season, here is a list of questions to consider when choosing your benefits. Read More

Investing for Specific Goals

In this video, Paul Sydlansky, CFP®, shares about aligning your investment strategy with your life goals and your comfort with risk. Whether you're investing for short, medium, or long-term objectives, Paul provides insights to help you make informed choices. Read More

How to Successfully Live Within Your Means & Reach Your Financial Goals

Living within your means requires a total change of mindset, and sometimes, a shift in your lifestyle too. Here are 5 helpful tips for doing so. Read More

Is Deferred Compensation A Smart Way To Save For Retirement?

Plus, get a quick intro on this unique way to save for the future. If your company offers a deferred compensation plan as a way to save for retirement, it’s important to understand the pros and cons of this type of agreement. After all, it may look attractive ... Read More

When and Why You Need a Financial Planner

Paul Sydlansky, CFP®, explores when it might be time to hire a financial planner and the benefits it brings to individuals and families. Read More

Should I Sell Shares of My Company Stock? Here’s How to Decide

If you have equity compensation like stock options, you might wonder: Should I exercise my options now? If so, do I then sell the shares right away? Or should I hold my shares and wait until the stock price goes up? ‘Should I sell my stock?’ is a common question ... Read More

Financial Moves To Make In Your 60s and Beyond

If you’re 60 or older, there are a few specific financial moves you want to focus on, like examining Social Security and Medicare options and revising your will. Read More

Understanding Net Worth: Building Your Personal Balance Sheet

In this video, Paul Sydlansky, CFP®, breaks down the basics of your balance sheet, or net worth statement, and how it serves as a cornerstone for personal financial planning. Read More

Financial Moves To Make In Your 50s – Are You Close?

Here are financial moves you can make in your 50s to set yourself up well for the decades to come, and help others if possible. Read More

What You Need to Know About Rental Property Investments

Paul Sydlansky, CFP® shares what you should consider before purchasing a rental property, including setting clear goals, understanding maintenance costs, and the implications of financing, vacancies, and taxation. Read More

Financial Moves To Make In Your 40s – Stay The Course

In your 40s, there are some tactical moves you can make to stay on track for meeting your goals. Read More

Breaking Down Homeownership: Buy or Rent?

Should you buy or rent? Watch this video for a discussion on this critical decision for those considering homeownership. Read More

Financial Moves To Make In Your 30s – Building Your Foundation

In your 30s, focus on building the financial foundation to help you achieve a secure long-term future. Read More

The Secret to Winning the College Savings Game

Are you making the most of your child's education fund? Join Paul Sydlansky from Lakeroad Advisors as he shares expert tips on how parents can best prepare to pay for college using a 529 account. Read More

Financial Moves To Make In Your 20s – Time To Build Habits

The best time to build good financial habits is when you’re young. Here’s our take on the most important money moves you should make in your 20s. Read More

The Boring Part of Finance That Will Build Your Wealth

It’s not an exciting concept, but understanding compound interest can help you create true wealth, no matter who you are and how much money you earn now. Read More

Our Clients Are Rolling Over Their Old 401ks Into IRA’s. Here’s Why.

You left your last job, and you’re about to tackle new challenges at a new company. As you pack up your desk and get settled in a new role, you may be wondering what happens to your old company-sponsored 401(k). Well, you could let the money just sit there. Or ... Read More

Are You Ready For a Change? 4 Questions To Ask Before Quitting Your Day Job

Do you daydream about leaving the rat race? Have you always wanted to start your own business? And have the last few years left you yearning for a new career path? If so, you’re not alone. Since the start of the pandemic, 20% of Americans have changed ... Read More

Don’t Make These 6 Expensive Financial Mistakes

What if I told you the world of providing financial advice has greatly evolved in the last decade? Do you know how it has changed and if you’re still taking an “old-school” approach to planning your finances? It used to be that financial planning was an ... Read More

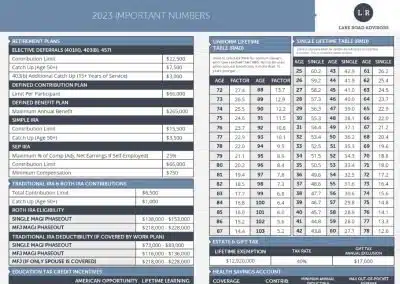

2023 Important Numbers

There are lots of important numbers that you need to keep in mind. In some cases, those numbers are annual limits that change each year. Other times, the figures do not often change, but are used frequently. Given the variety of sources that report relevant ... Read More

5 Advantages of a Trust and Why Your Family Needs One

You’re a young family who’s still growing. So why would you need a trust? Aren’t those just for wealthy families who are older? Actually, trusts are an important way to take care of your family—at any stage. Here’s why. Today’s modern lives can be complicated, ... Read More

How To Manage Your Blended Families Finances

According to the U.S. Bureau of Census, more than 50% of American families are remarried or re-coupled, and every day, more than 1,300 new stepfamilies form. If you’re part of a blended family, you’re certainly not alone. It can be a rewarding process, but it’s ... Read More

How To Help Your Aging Parents With Their Finances

None of us want to admit it, but one day, our parents will be elderly (if they’re not already). And age brings unique challenges, including potential declines in physical and cognitive health. It’s hard to imagine, but the strong people who raised us may, one day, ... Read More

Thinking About Your Kids’ College Education? Find Out The ROI Now

College is expensive, to say the least, so it’s important to get the most “bang for your buck” when deciding on higher education. Fortunately, a new study done by Georgetown University’s Center on Education and the Workforce (CEW) ranks 4,500 colleges and ... Read More

Leveraging Home Equity to Grow Your Wealth

The expansion of prices in the housing market combined with record-low interest rates means that families across the country are growing their net worth simply by being homeowners. As of November 2021, housing prices have increased 18% year over year.1 As you ... Read More

Lake Road Advisors Hires Hayley Haslett, CFP® for Associate Advisor Position

CORNING, N.Y. (PRWEB) MARCH 24, 2022 Lake Road Advisors, a fee-only financial planning firm in Upstate New York welcomes Hayley Haslett, CFP® to the company as an Associate Advisor. Prior to joining Lake Road Advisors, Haslett served as an Associate Advisor for ... Read More

3 Important Tax Guidelines You Need to Know in 2022

We’ll explain how working remotely may impact your tax return, the tax rates for long-term capital gains, and how some business owners can work around the cap on state and local tax deductions (SALT). Did you work remotely for most of 2021? According to a ... Read More

Three Key Steps to Take to Plan Your Financial Future

As a financial planner, I get a wide range of questions from people who are considering hiring me to help them address an issue they’re facing. Some of them have very specific concerns about an investment they’re considering or the diversity of their portfolios. ... Read More

Am I Doing OK?

If you're reading this article, chances are you're already working hard to build a financially secure future. But how do you know if it's enough? In a culture that frowns on honest financial conversations, it can be difficult to gauge how well you're doing ... Read More

Insights from a 13-Hour Training Course on Cryptocurrency, Part 2 – Should You Invest?

After reading our first article regarding cryptocurrency, you probably want to know if I think of this class of investment options: Thumbs up or thumbs down? Sorry. There’s no easy answer. I’ll explain. Our First Questions: What Do We Know and What ... Read More

Insights from a 13-Hour Training Course on Cryptocurrency, Part 1 – Terms and Background

In 2017, I wrote about cryptocurrency – the digital rival to our traditional financial instruments – and for the longest time I avoided a deep dive into the topic because it felt like a fad. Four years later, cryptocurrency – Bitcoin, blockchains, digital assets ... Read More

Investment Lessons from Theranos: Don’t Let a Good Story Bleed You Dry

If you have been following the trial of former Theranos CEO Elizabeth Holmes, you may be wondering how so many wealthy, well-informed and sophisticated people were duped into investing hundreds of millions in a sham company. Unfortunately, their financial blind ... Read More

Five Key Financial Tips for New Parents: Embrace the Changes!

Becoming a parent for the first time is thrilling – an experience unlike any other. As many have likely told you, your life will change dramatically. You also probably know that your financial life will have to change as well. This is usually a hectic time, so ... Read More

Have Charitable Giving Goals? Consider a Community Foundation

Do you have aspirations of making an impact in your local area, but feel overwhelmed at the thought of managing a charitable contribution? Or maybe you feel motivated to give back, but aren’t sure of how to do so; maybe you’re not sure how much to give, or exactly ... Read More

Participating in an ESPP Plan: How to Decide If It’s Right for You

Wouldn’t it be nice to get a guaranteed 15% in profit whenever you wanted to sell shares of stock you own? It sounds too good to be true… but with benefits like employee stock purchase plans that can be part of equity compensation packages, this kind of deal ... Read More

CERTIFIED FINANCIAL PLANNER™ vs Financial Advisor: What’s the Difference?

Recently, a client told me about a conversation they’d had with a friend. The client’s friend claimed they did not work with a financial advisor because advisors charge high commissions. This is a misconception that many, many people hold as the truth - and ... Read More

The Two Formative Experiences That Helped Me Grow as an Investor

Who doesn’t like getting insights into the balance sheets and investment portfolios of other people - especially when those other people are successful professionals or financial experts? CEO and co-founder of Ritholtz Wealth Management, Josh Brown, recently ... Read More

Investing FOMO Is Real – But Here’s Why You Shouldn’t Give In

The fear of missing out is real in many aspects of our lives. Today more than ever, with how ingrained social media is in our society, it’s hard not to let that fear, or FOMO, affect how you think and feel about your own decisions. FOMO impacts all of us. I see ... Read More

What Type of Investment Account Is Best for My Kids?

If you’re a parent, you want the best for your children. There’s never an exception to that desire - even when it comes to the type of investment account you should use to help them secure their own financial futures. The fact that you want to choose the optimal ... Read More

What to Consider Before Going from a Dual Income Household to a Single Income

We work with many clients who have a dual income household. They’re usually married and both spouses are professionals in demanding fields, and often, they also have children. Undoubtedly, at some point or another, these clients face an important question: ... Read More

5 Signs You Need an Accountant for Your Taxes

When it comes to doing things yourself, or hiring someone to help you, most people ask a simple question to decide: “Can I do this myself?” The answer to that is usually pretty simple, too. It’s either yes, you can, or no, you can’t. If you can’t do something ... Read More

The Number One Reason to Work with a Financial Planner

No matter what their age or background or income or level of wealth, there’s one question we ask every single client who works together with us at Lake Road Advisors: Why did you reach out to us? It’s really important for us to understand what motivates ... Read More

Is That Hot Investment Worth the Risk?

Day trading was trendy decades ago and popular again today, helped along by apps like Robinhood. Many people feel it’s an easy way to make money and earn a return on your investments; many others who are out of work due to the pandemic feel it’s a viable way to ... Read More

Wills vs. Trusts: A Quick & Simple Reference Guide

We are happy to have Laura Cowan back with us once again in an effort to continue to bring you valuable insights. Laura is an estate planning attorney that focuses on helping individuals and families make important decisions today to avoid unnecessary pain and ... Read More

Thinking About Day Trading? You May Want to Read This First

In the midst of the pandemic, you may have noticed a rather unusual trend: more and more people are jumping into the stock market. Despite, or perhaps even because of, extreme volatility in the market and endless speculation about what could happen next not ... Read More

The Lessons We Can Learn from Times of Financial Crisis

It's time to step back and take a look at how you weathered the coronavirus crisis. Did your cash hold up? Does your job feel secure? Your answers could reveal the need to make some adjustments for the future. Learn more in our latest Kiplinger article, "The ... Read More

What Are ETFs? Understanding These Tools and Their Uses in Our Investment Portfolios

If you have a retirement plan, brokerage account, or other type of investment vehicle, you’ve probably at least heard of a mutual fund before. Mutual funds allow easier access to a wider array of securities and assets than most investors could access or afford ... Read More

Thinking About Selling Some of Your Stocks? Read This First

You probably know that any investment you make comes with risk. While many people think “risk” has a negative connotation, it’s actually not an inherently bad thing. We need risk in order to have the potential to earn a reward. The greater the risk, the greater ... Read More

Is Now a Good Time to Invest?

Yes, stocks are "on sale" now, and for some investors, now is an ideal time to ramp up their portfolios. But for others, it could be a huge mistake. Read our latest Kiplinger article "Is Now a Good Time to Invest?" to find out if you’re among those who should hit ... Read More

How to Handle Your Personal Finances During a Crisis

There’s no doubt that the current events unfolding around us are worrying, stressful, and potentially dangerous — both to our physical health and our financial well being, too.The reality is that we’re in the midst of a human and financial crisis. So what can we ... Read More

It’s a New Year — But You’re Still Not Working with a Financial Planner?!

We’re a few months into the new year (and new decade!) now. How are your resolutions to “do better” holding up so far? If you’re like many people, despite your best intentions, there are probably a few things that have fallen by the wayside. There might be some ... Read More

Your Most Common Questions, Answered: We Have a Lot of Cash in the Bank, Now What?

What’s the best thing to do with your money now that you actually have enough of it to make complex decisions around? Read More

Credit Score Myths to Stop Falling For Now

Yes, a good credit score is important and increasing your score (or maintaining it in the 700 to 800 range) is a worthy goal. But no one is giving you a gold star or cutting you a check if your credit score is good to excellent; it just means you might have an easier time getting approved for financing. Read More

Do I Need Disability Insurance?

Where life insurance protects people you might leave behind that depend on your income -- like a spouse or minor-aged children -- disability insurance is designed to protect you from a loss of income. Read More

Is a Credit Union Right for You?

Despite boasting over 100 million members in the U.S., credit unions are often neglected in today’s crowded financial services market. Many consumers don’t consider joining a credit union when it comes time to open a new checking account or apply for a loan. Others assume they don’t qualify for membership or are wary of a credit union’s perceived limitations.It’s a good time to take another look at credit unions. They are evolving in many ways and may be a great fit for your financial needs. Read More

Do You Save for College or for Retirement? What Parents Need to Know

Here's a message that all parents need to take to heart: It's OK to put yourself ahead of your kids. In fact, putting your retirement needs ahead of their college costs is not only necessary but wise ... and, ultimately, thoughtful, too. Read More

What’s the Best Way to Manage an Inheritance or Other Lump Sum of Money?

Having someone you love pass away and leave you a lump sum of money is not quite the same as stumbling upon a twenty-dollar bill on the ground. You may have a lot of grief, confusion, or even anger that you feel about your loss -- and you also have a lot of financial decisions to make now.So what should you do -- or not do -- if you find yourself in this situation? How do you sort out your newly inherited assets? Read More

Do I Need Life Insurance? What to Think About Before You Decide

How much insurance do you really need? And what if you don’t need it at all? Read More

Feeling Financially Disorganized? Take Back Control, Starting with Your Cash Flow

Getting a grip on your spending and ramping up your ability to save starts with just a few simple steps ... and three buckets. Read More

Why Entrepreneurs and Small Business Owners Need to Put Profit First

Profit First lays out a process for better accounting and financial management for your business (or freelance income), and gives a simple method for prioritizing the right factors. Read More

Should You Supplement Your Traditional 529 with a Private 529 College Plan?

There are a few reasons to consider this strategy. One is if you think your child might want to go to a private school one day, and another is if you like a sure thing rather than taking investment risks. Read More

The Biggest Question You Might Ask About Social Security Benefits: To Wait or Not to Wait?

There aren’t many absolutes in personal finance or financial planning. But when it comes to Social Security, you can be almost certain you’ll face this decision that requires you to choose: Read More

2 Critical Ways to Hold Yourself Accountable to Better Financial Decisions

Accountability is one of the best tools you can use to make better financial decisions and take the necessary actions after you decide what to do. Unfortunately, it’s also probably one of the hardest parts of achieving financial success. Read More

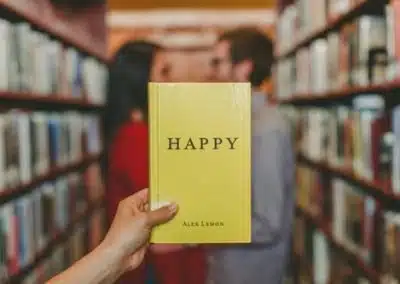

The Psychology of Money, Part III: Pay Now But Consume Later and Invest in Others

The final post in our three part series continues to look at the ways Dunn and Norton, authors of Happy Money, suggest we change how we use our money so that we can get more happiness from every dollar we spend.The first is the idea that we should “pay now, consume later,” and the second is that to get the most from our money, we might want to spend it on others instead of ourselves. Read More

The Best College Savings Strategy to Use

A 529 college savings plan comes with many advantages, and the best way to harness its power is to start ASAP and front-load your contributions. Read More

The Psychology of Money, Part II: Make it a Treat & Buy Time

If you haven’t read it yet, I recommend starting with this post first. Once you catch up, head back here to continue the conversation. Today, let’s look at Principles 2 and 3 from Happy Money authors Elizabeth Dunn and Michael Norton. If you understand and use these principles in your day-to-day life -- and in your bigger-picture, long-term financial planning -- you can enjoy a greater degree happiness when you spend. Read More

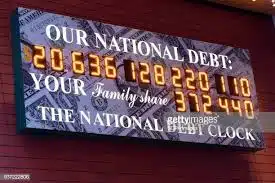

The Problem with Federal Spending – and How It Impacts You

One major financial issue we currently face certainly impacts you right now. It’s our level of federal spending and the current deficit, and whatever your politics, the issue does affect you. Read More

The Best Way to Handle Stock Market Ups and Downs: Get Used to Them

Once you get a realistic understanding of what to expect from your investment return, you’re better prepared to face the next challenge the market throws at investors: dealing with its ups and downs. Read More

What’s Your Investment Return? Setting Expectations for Your Stock and Bond Portfolio

You are not average, and your portfolio returns aren't likely to be average, either. Trusting averages can be dangerous. But don't let that scare you away from the markets, because just staying in cash can be dangerous, too. Here's what to do instead. Read More

Understanding Expense Ratios

Most investors look at their statements and see the “advisory fee” they pay from their account. But many investors are surprised to find out that the mutual funds they hold also charge them a fee that never shows up on their statement! Read More

2 Important Tips on How to Manage the Household Finances as a Couple

Often, married couples will divide and conquer tasks as a necessity to get their family to-do list done. Yet, when it comes to finances, this notion of “dividing and conquering” may not be your best bet in the long-run. Read More

Understanding Investment Fees

The higher the investment fees, the lower your return. This simple fact makes it critical that every investor understand the type of investment fees they are paying and why Read More

What to Do (and Not Do) When the Market Drops

Things are pretty wild on Wall Street right now, but before you make any moves, read this. Read More

Can Money Buy Happiness?

We all know that the more resources you have, the better your ability to achieve your goals.But few people think about how the psychology of spending and saving can increase happiness. Read More

Two Arguments Against Indexing & One Fact

Index investing is a trend on the rise. I have written multiple articles (Why I Believe in Passive Investing and Index Funds and Passive Fund Management: Understanding the Opportunity) on the many benefits of investing in index funds. As with anything that gains popularity and threatens conventional wisdom there are counter arguments as to why index investing may not be the best thing for you or the market. Read More

Have You Taken Steps to Protect Your Credit?

It may seem like forever ago, but it was only a little over a year (Sept 2017) when we were all shocked by the major Equifax Data Breach. The breach resulted in more than 145 million people’s personal information, like Social Security numbers and birth dates, being compromised. That is almost half of the entire United States! And, yet, even more worrisome, AARP found that just 14% of the 2,000 compromised individuals it surveyed actually took steps to freeze their credit. Read More

Lake Road Advisors Announces New Partnership with Vestwell

Lake Road Advisors, a fee-only financial planning firm in Upstate New York, has partnered with Vestwell in order to provide comprehensive, customizable, and more affordable retirement plans for small business owners and their employees. This partnership brings a new investment solution to clients of Lake Road Advisors, who are often young professionals and entrepreneurs looking for financial security. Read More

6 Biases That Can Impact Your Financial Behavior

A sound investment philosophy is important, however, increasingly important is your behavior about money. After all, it’s the actions and decisions you make with your money that determine your financial success. Read More

What Today’s Economy Means For Investors

Too often, financial headlines can be misunderstood or a source of fear. Here’s what investors can do with current economic news. Read More

Recent Grad That Can’t Find a Job? Here’s What to Do

If you’re a college graduate that can’t seem to get your foot in the door, these practical tips should help. Read More

How Your Financial Planner’s Network Can Help

If you have ever thought about hiring a financial planner, it may have been for one of these common issues. Perhaps you are looking for help to better understand investing and the markets, or maybe you need to get on track financially or are close to retirement and need to know if you will be ok. Read More

These 2 Accounts Offer the Best Tax Advantage and Here’s Why

Understanding the different ways investment vehicles are treated from a tax standpoint can be tricky business. Terms like ‘tax-deferred’ and ‘tax-deductible’ can be confused or misunderstood given the gamut of financial jargon that peppers almost any financial literature. But knowing how certain retirement savings tools are taxed can go a long way at helping you build a tax-efficient investment strategy. After all, whatever you save in taxes can be allocated towards funding your financial goals. Read More

The Big Difference Between a Fee-Only & Fee-Based Financial Advisor

How is your financial advisor compensated? This should be at the top of your considerations when selecting a financial professional. Read More

Why Titles Mean Little and Designations Mean Everything

Have you ever noticed how many people call themselves a financial advisor? Anyone can use the title financial advisor, but there’s something you should know. Read More

3 Reasons Risk is Not a Bad Thing

Just about every investor wants safety, income, and growth, but is it possible to have all of these things at the same time? The short answer is no, but that’s not a bad thing. Read More

The Index Revolution & What It Means For You

When it comes to investing, a passive (or index) investment strategy makes sense for the majority of people. Here’s why even Charles D. Ellis thinks so. Read More

The 5 Most Common Estate Planning Mistakes Parents Make

Virtually every parent would agree that their children are by far their most valuable asset. Yet few parents do what is necessary to ensure their children are taken care of by the people they want should the unthinkable happen. Read More

Here’s Why You Need to Think About the ROI of Education

While it’s impossible to precisely predict the return on your college investment (ROI), having an awareness of the general expected return is important in making a decision that will have a huge impact on your long-term financial success. Read More

4 Things You Didn’t Know About Estate Planning

Here are four things everyone needs to know about estate planning. Read More

Protect Yourself From Being Hacked Right Now

In today’s digitally connected world, it’s no longer a question of “if” you’ll be hacked – it’s more of a question of “when” you’ll be hacked. Are you prepared? Here are seven ways you can protect yourself. Read More

Get Beyond The Price

In an effort to continue to bring you valuable insights, this month's guest post is from Billy Van Jura, a Partner with Fraleigh & Rakow, who I often turn to with my toughest insurance questions. Read More

How Fees Erode Your Wealth

See how that extra .75% a year in your total fees compounds over the long term and greatly reduces your wealth! Read More

Index Funds and Passive Fund Management: Understanding the Opportunity

There is a more cost-effective way to invest your money. Are you taking advantage of it? Read More

Expense Ratio – The Fee That You Will Never See!

If you invest in Mutual Funds, you need to read this. Read More

Tax Reform: How Will It Affect Me?

In an effort to continue to provide you valuable personal financial information, over the net few months we will have a series of guest bloggers from the tax, insurance, and legal fields. This months guest post is from Megan Hubbard, CPA Senior Tax Manager at Mengel, Metzger, Barr & Co. LLP who specializes in individual, corporate, and partnership taxation and services a variety of industries. Read More

When Will the Market Stop Going Up?

Stock market's value has grown 320 percent since it hit rock bottom on March 9, 2009, but how long can investors expect this trend to continue? Read More

My Entrepreneurial Story

This week marks my two year anniversary of becoming an entrepreneur and I couldn’t be more grateful for the experiences and lesson learned. I’m often asked how I got here, I hope this can help other career changers and entrepreneurs as they contemplate what’s next. Read More

2 Simple Ways to Better Manage Your Cash Flow

Everything starts with cash flow. It’s time to get financially organized! Where do you even start? It’s the core of how you allocate your limited resources. Unfortunately, it’s an area I see many struggle. Read More

The Psychology of Saving Money: Why some do it successfully and others struggle

A sound financial plan has a variety of elements. These elements include everything from retirement planning to an understanding of investments and financial choices. However, I can’t emphasize enough how important your ability to save money is to your financial future. Read More

Why Your Child’s 529 Plan Should Be Direct

With the cost of higher education rising steadily over the past few decades, more and more families are opting to use a 529 state plan to save up the necessary funds for tuition, room, board, and textbooks Read More

Get on the Road to Financial Success with These 4 Behaviors

Financial success is rarely the result of one defining event in one’s life. Rather, it’s more likely the result of good money habits over months and years. As a financial advisor, I’ve seen people achieve financial success first hand by doing nothing more complicated than demonstrating a few smart behaviors. Read More

Know the Lingo – the daily market recap and how it affects you

Here is what you need to know when it comes to the daily market and the actions you, as the investor, can take. Read More

The 3 Unbreakable Rules for Financial Success

I recently had a friend ask me what the three most important pieces of advice you could give someone about their finances. This really made me think, “If I could only provide three pieces of advice, what would they be? What is the most impactful information I could pass on?” Read More

Follow These Steps When Selecting a Financial Advisor

When it comes to securing your economic future, it’s important to select the right financial advisor. No matter how educated or market savvy you are, professional financial advice can be invaluable when your finances grow to a level that creates more complexity, or when you may not have the time, energy or desire to manage your finances. Read More

Why You Should Choose a Fiduciary as a Financial Advisor

As of recently, the fiduciary standard – what it is and who is legally required to abide by it – has made the round of headlines. Just Googling “fiduciary standard” pulls up news article after news article about potential regulatory changes and the political arguments surrounding them. Read More

Investing in Cryptocurrency – Know the Risks

I have seen plenty of articles, blogs, and news stories recently on cryptocurrency, cryptocurrency mining, and the Bitcoin fork. I even have a personal friend who has hopped on the cryptocurrency bandwagon, if you will, and realized many more investors may be considering cryptocurrency for their own portfolios. Read More

Why This Rule Of Thumb No Longer Applies

Asset allocation is an important tool when it comes to planning for retirement and achieving financial independence. It allows you to carefully balance risk versus reward within your investment portfolio by appropriately aligning the assets within it with your long-term goals Read More

How Am I Doing?

Before you can find out how you are doing financially, you should be willing to do what it takes to be where you’d like to be financially. So let’s unpack this common question and see where you stand. Read More

Do I Pay Off (Student Loan) Debt or Do I Invest Instead?

While everyone’s financial situation is unique based upon their values, goals, and resources, we've come up with some productive ways to help you think about the problem and make an informed, rational decision. Read More

Understanding The Power of Compound Interest

Compounding interest (or compound interest) is the most important concept in investing. Read More

Can I Retire Early?

Here's a list of fundamental questions you'll need to answer to decide if you can retire early. Read More

Diversification: The Right Way to Manage Risk

I’m sure you’ve heard this saying, “Don’t put all your eggs in one basket.” There is a good reason for this popular idiom, and it has to do with your ability to safely manage your exposure to risk in your investment portfolio. Read More

Having A Tough Conversation & Helping Your Aging Parents

Here's an overview of the most important factors you'll want to cover with your parents sooner rather than later. Read More

What Everyone Should Be Doing Post-Tax Season

Tax season has come and gone, and you may be thinking you don’t need to think about taxes again for quite a while. On the contrary, now is the perfect time to start preparing for your 2017 tax return. Read More

Want to Raise Financially Savvy Kids? Try These 5 Steps

Here are 5 actionable tips to start your child’s financial education early and strong: Read More

Inflation: What Every Investor Needs to Know in 2017

As a consumer and investor, here is what you need to know about inflation in 2017 and how you can protect the value of your money. Read More

Getting Married? Have This Conversation Now

When you understand and discuss your experiences and deepest beliefs about money early on, before the marriage, even couples with differing money mindsets can find a happy middle ground. Here’s how: Read More

The Ultimate Guide for Choosing Financial Advice

There is no shortage of financial guidance available, but it’s important to understand which financial help is right for you. Download this comprehensive whitepaper to learn the questions you should be asking a potential advisor. Read More

Get Financially Organized! Where Do I Even Start?

Knowing where you stand financially is as simple as understanding these two personal financial statements: Read More

How to Start Investing Today

Contrary to what you may have thought, you don’t need a lot of money to start investing successfully. Read More

Don’t Buy a Starter Home!

If you were around during the housing boom of the last decade, then you may be prone to some flawed thinking. I should know because I was too. Read More

Rethinking Retirement: How The Game Has Changed

Rethinking retirement doesn’t mean that you won’t have more time for fun, leisure, and, yes, even more golf (if that’s what you want). What it means is that you don’t have to spend your pre-retirement years waiting for your “good life” to begin. It can begin right now with just a little intentional planning. Read More

4 Ways to Build Wealth Right Now

With everyday intention, planning, and discipline, you can build wealth. Here are four ways you can start building wealth: Read More

5 Steps to Get Your Finances Ready for 2017

2016 has been one crazy financial ride. From record lows when the year opened to the DOW nearly reaching 20,000 before the last minutes of 2016 tick to a close, now is the perfect time to position your finances for success in the New Year. Read More

How Much Should I Invest In My Company Retirement Plan?

If you're asking that question, you're already on the right track because you're saving. Step Two: figuring out how much to invest. Read More

The True Value of Financial Planning

The financial world is changing rapidly. We want to give you the insights and information you need to successfully leverage the changes we see in the way investment management is done. Read More

How About What Not To Do With 401(K) Contributions

To help you get the most out of your plan, here's what not to do. Read More

Keeping it All Together: How to Balance Personal Financial Goals with Running Your Business

As a business owner, your time may be monopolized by running your business. That could mean your personal financial goals are being neglected. Here's what you can do to keep your personal goals on track while you run your business. Read More

Nervous About The Election And Your Investments?

Traditionally, stock volatility intensifies around election time. What does that mean for your investments? Read More

30-Somethings: Why are You Wasting Time Following the Stock Market?

You're young, you have a family... so why on earth are you wasting your time worrying about what the stock marketing is doing? After all, who KNOWS what it'll be doing 30 years out, when it's actually going to matter for you. Read More

Will 30 Year Olds Ever Get To “Retire”?

If you're in your 30's right now, you might feel that those golden years of retirement may never happen. Experts are predicting that Millennials will have to keep working until they drop dead. But can this really be true? Read More

Educating Your Kids About Finances

Did you know that when it comes to teaching our kids about money, we may be doing it all wrong? Here's what you should be teaching them instead. Read More

3 Crucial Tips For Living Within Your Means

You've heard of it, but you're not sure what it means: "living within your means". And now, because you want to reach your financial goals (or because you're forced to)... you want to learn how to live within your means. Here's an easy to follow guide to getting started. Read More

Why Budgeting Doesn’t Need to Be a Dirty Word

Budgeting, which is typically a backwards-looking approach to estimating future spending based on past spending, can be incredibly uncomfortable for all if it involves accusations, criticisms and finger-wielding for past spending decisions. Read More

What Does a Financial Planner Do?

When I tell people I am a financial planner, I often get a friendly head nod with not much else. On a few occasions people will ask ok, but what do you actually do? Read More

What Financial Health Means To Me

“Households that plan ahead for large, irregular expenses are 10 times as likely to be in the financially healthy segments than those that do not plan ahead.” Read More

How Your Advisor Can Help You Behave

Behavioral Finance is a field of study that combines psychological theory with finance and economics. It aims to understand why investors act the way they do. Behavioral finance shows that investor’s choices can often be explained by behavioral biases, or traps, that can sometimes lead to bad decisions. Read More

It’s Urgent, But Is It Really Important?

I recently read a great article in Entrepreneur Magazine titled “Stop Paying Attention to the Non-Urgent in Your Life. Learn How to Single-Task” by Matt Mayberry. The article discusses how we can more effectively deal with our never ending to-do list. Read More

How To Achieve Your Goals

At Lake Road Advisors our business is built on helping our clients achieve their financial goals. This is no easy task as these goals can be extremely long term and very difficult to quantify.So how do we do it? By following these 4 steps whenever possible. Read More

Understanding Your Fee Schedule

To help you better understand your fee schedule, I have a listed a few questions you should consider asking your advisor: Read More

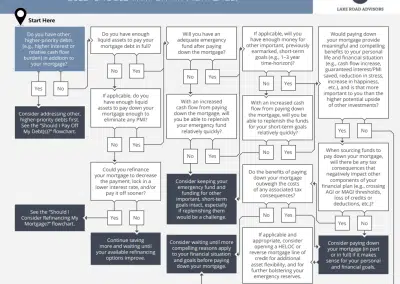

Should I Pay Off My Mortgage Early?

Let’s take a look at 3 reasons why you shouldn’t pay off that mortgage debt early: Read More

Incentives Matter!

In last week’s Wall Street Journal, one of my favorite writers, Jason Zweig, wrote an article entitled “Mutual Fund Fees: A Bad Incentive Fades Away” which highlights a known conflict of interest that exists in the financial services industry where advisors are paid by mutual fund companies to sell their proprietary products over other funds. Read More

Why I Believe In Passive Investing

I worked for almost a decade in the Hedge Fund industry. For a majority of my tenure, like most in the field, I was a believer in active management. Active management is the ability for a talented portfolio manager and a room full of analysts to deliver outperformance on a consistent basis. Outperformance is based on a benchmark index like the S&P 500. The idea is that the market will return what it does on average every year (6-7% historically) but these managers can beat that number with expertise and skill. Read More

Is This A Good Investment?

As a financial planner and investment advisor I am often asked “Is this a good investment?” Here are 5 questions you should ask yourself before you move forward with making any investment. Read More

Why I Started Lake Road Advisors

Last week, I founded Lake Road Advisors, a financial planning and investment advisory firm. Since my launch, many people have asked me, “Why did you start your own business?” Read More

Launch Day!

After working for 16 years in the financial services industry, I believe there is a better way to empower people to achieve their goals. Read More