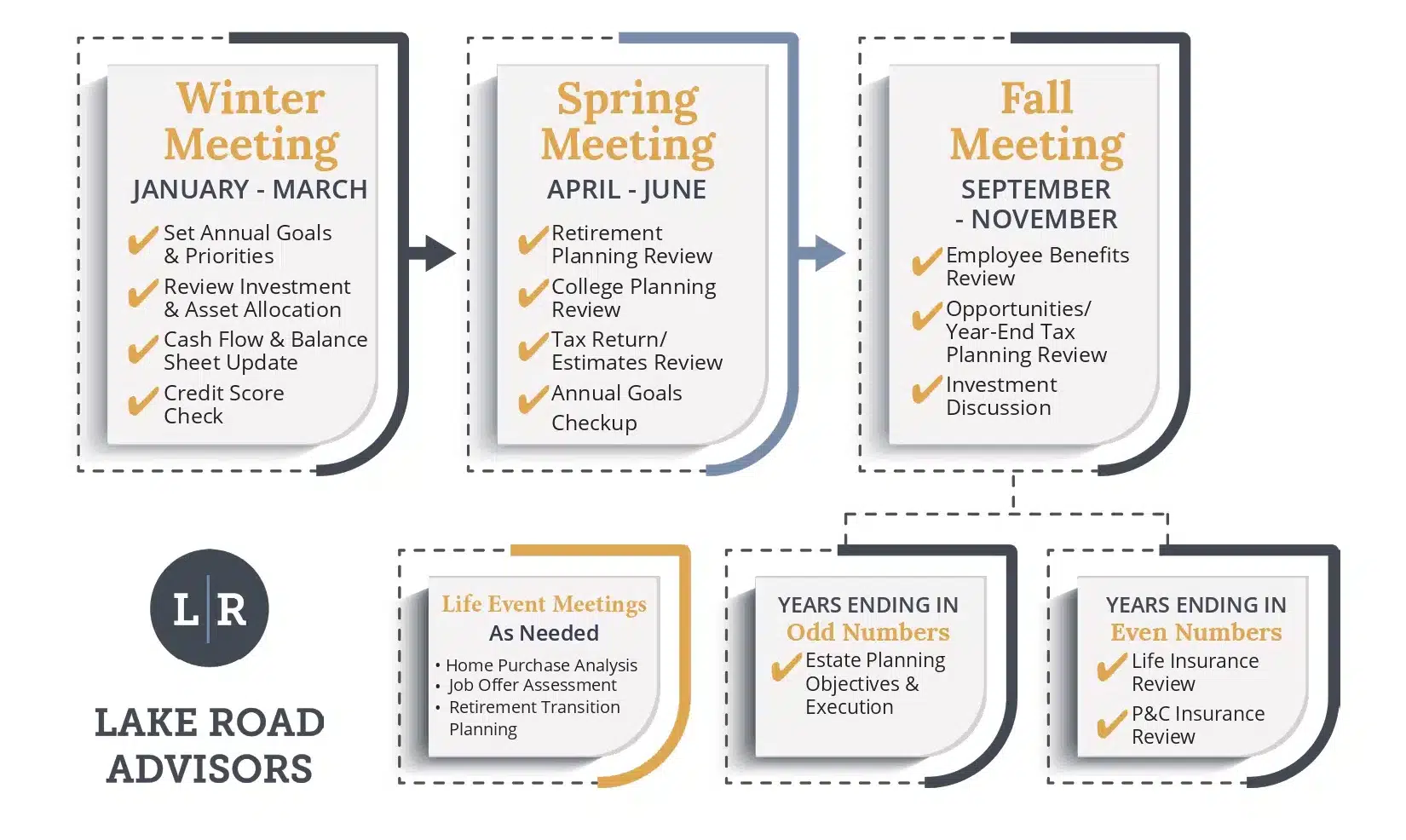

Working With Us

First, We Understand Your Current Financial Picture

Your Cash Flow and Balance Sheet statements are your two main foundational reports that paint the picture of your financial health. We build them with you leveraging our financial planning software RightCapital.

Cash Flow

It’s simply money going in and out; however in reality, very few have a system or process to manage it. Do you know how much you spend per month? How much you invest per month? Should you be doing more to reach your goals quicker?

Balance Sheet

Do you know your net worth? Are your assets “working for you?” Do you have too much debt on your balance sheet? Are you diversified enough? Should you have more assets by now?

Next, We Build For The Future….

Below are some of the core financial planning areas we review to ensure you are prepared for the unexpected and on the right path to achieve your goals:

Insurance

As a fee-only independent firm, we don’t sell any insurance, but we provide you an unbiased opinion to make sure you have the right insurance for your family. Do you have too much or too little life insurance? What about umbrella insurance? Renters insurance? Identity theft insurance?

Retirement Planning

It still may seem far away, but you are probably now closer to the end of your career than the start. Do you have a plan? Are you investing enough to lead the life you want? What is the earliest you could be financially independent?

College Planning

Have you started saving? Is it too late to start? What is the best investment vehicle for your child? Do you have enough saved? Will your child get financial aid?

Estate Planning

This is often the most overlooked piece of your financial puzzle but arguably the most important. Is your family protected in case something happens to you? Who would take care of your kids? Who would handle the finances?

….While Investing With Confidence

We often hear new clients worry that they’re not reaching their investment potential. Whether you’re just starting out with investing or want to refine your existing strategy, we’ll offer straightforward insights to help you maximize your investing power:

Investment Management

Are you investing properly for your goals and your risk tolerance? Are you investing enough of your income? How do you make your money work for you? Is real estate a smart investment?

Tax-Sensitive Investing and Planning

Are you getting the most out of your tax return? Do you take into consideration how your investments (stocks, bonds, rentals, options, RSUs) provide income that can be taxed differently based on the source of the income or duration of how long you have held the asset? Our team incorporates the tax implications of all your financial decisions.

Equity Compensation Planning

How does your company stock, options, and RSU’s fit into your overall financial plan? Are you overexposed to your company? Do you have a plan to reduce that exposure in a tax efficient way?

Want To Hear From A Client What It’s Like To Work With Lake Road Advisors?

A Case Study

Download our case study to hear from the Goldwyn family on the challenges they faced and the results they received.

Challenges

- Saving for retirement

- Household budgeting

- Gaining control of expenses

Results

- Reduced debt

- Improved budgeting

- Increased savings for retirement & college

Ready For The Next Steps?

Click here to get transparent pricing details and see how financial planning fits with your budget.

Our 3 Value Adds

At Lake Road Advisors, we provide value in 3 ways:

Portfolio Value: Helping you design and manage investment portfolios; providing optimal portfolio construction, tax efficiency and withdrawal sequencing.

Planning Value: Improving your financial outcomes through financial planning; consistent savings and investing, managing debt, tax savings, college planning are just some of the ways we can help.

Personal Value: Too often financial decisions are driven by our feelings and fears rather than facts. Our fiduciary partnership provides you a guide along your financial journey. We can help reduce your risks, maximize your financial returns and achieve your goals by helping you navigate your life with greater clarity, confidence and peace of mind.