I am commonly asked “should I try and pay off my mortgage early?”

My response is, “why do you want to pay it off early?” Frequently the answer is, “because it’s my only debt and I want to be debt free”.

Don’t get me wrong, living debt-free is ideal, however not all debt is created equal and living a completely debt-free life is not realistic for many people. Mortgage debt compared to other types of debt, such as, credit card debt should not always be considered “bad”.

Let’s take a look at 3 reasons why you shouldn’t pay off that mortgage debt early:

1. It’s the cheapest money you will ever borrow

Loans are provided to consumers based upon their credit worthiness and the asset that the loan is being made against, known as collateral. Interest rates are higher for those with lower credit scores and for loans that have collateral in which it may be difficult for the lender to recoup should the borrower default.

As collateral goes, a house, a tangible asset, is one of the most desirable types of collateral for lenders. In comparison to a credit card, where the collateral is your ability to pay it back.

30 year fixed mortgage rates are still in the all-time low vicinity (the lowest average rate on record was 3.31 percent according to Freddie Mac’s Primary Mortgage Market Survey). Borrowing money today at current rates under 4% is a good deal.

2. What other goals are you sacrificing to pay down your mortgage early?

Investing as early as possible in your retirement is important. The biggest advantage investors have is time, the earlier you start investing the longer compounding has a chance to work its magic.

Not investing in your 401k/IRA because you are putting all of your extra disposable income toward paying off your mortgage early is not something I would recommend.

Besides, why are you in a rush to get a 4% return (what you are earning by paying off that mortgage early) when stocks historically return 6-7% over the same time period?

3. What does your “emergency fund” look like?

What is an “emergency fund” and why should I have one? It’s an account, usually a savings account, which holds cash that equates to 3-12 months of living expenses. I recommend that all of my clients have one.

Life happens. Your basement may flood, your car could break down, and there is always a chance you could lose your job. Having these funds set aside provides a cushion so you can handle these unexpected budget items without racking up credit card debt and/or dipping into your investments.

While living debt-free is a smart goal, remember that not all debt is created equal. With a sound financial plan you can work towards your goals and carry some debt.

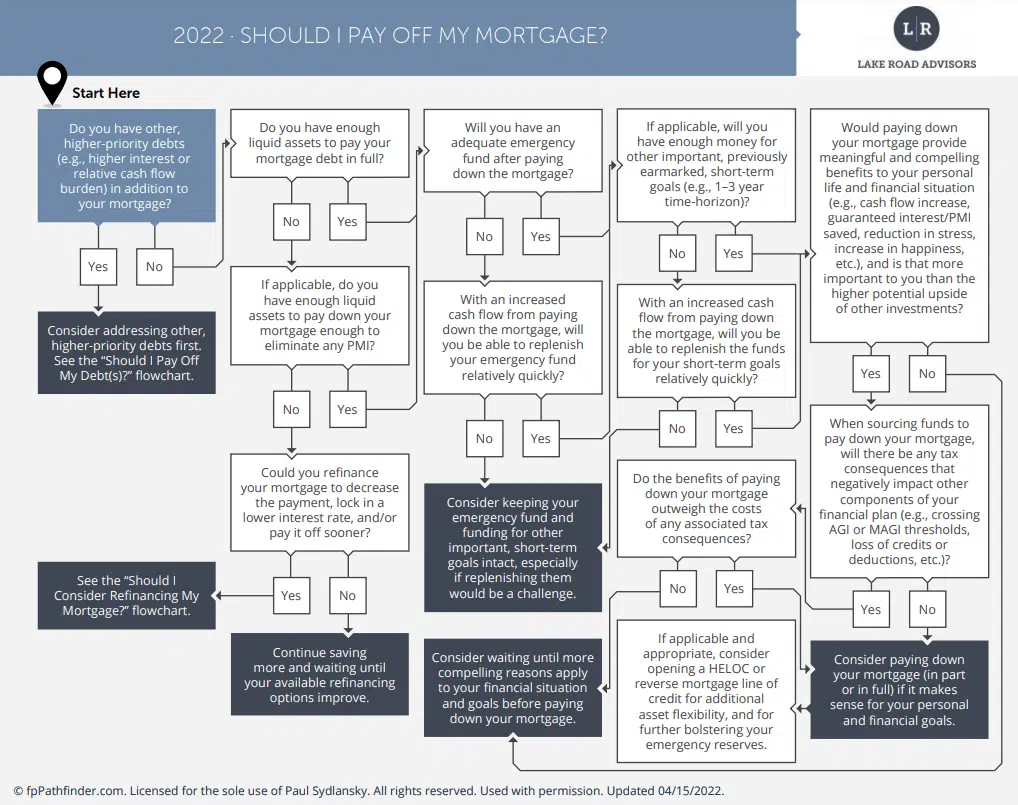

Not convinced? Follow our flowchart shown above to see if paying off that mortgage makes sense for you!